How to File an Online Tax Return in Australia and Ensure Your Information Is Accurate

How to File an Online Tax Return in Australia and Ensure Your Information Is Accurate

Blog Article

Navigate Your Online Tax Obligation Return in Australia: Vital Resources and Tips

Navigating the on-line tax obligation return process in Australia calls for a clear understanding of your obligations and the resources available to simplify the experience. Vital papers, such as your Tax Obligation Data Number and earnings statements, should be carefully prepared. Furthermore, selecting a proper online system can dramatically affect the effectiveness of your filing procedure. As you take into consideration these variables, it is critical to also understand common risks that several experience. Comprehending these subtleties might ultimately conserve you time and decrease stress-- bring about an extra desirable result. What strategies can best help in this undertaking?

Comprehending Tax Commitments

Understanding tax obligations is essential for people and businesses operating in Australia. The Australian taxes system is governed by different laws and regulations that need taxpayers to be familiar with their responsibilities. Individuals have to report their revenue precisely, which consists of wages, rental revenue, and financial investment profits, and pay taxes as necessary. Furthermore, citizens must comprehend the difference between non-taxable and taxable earnings to make sure conformity and optimize tax obligation results.

For businesses, tax obligation responsibilities include several facets, including the Goods and Solutions Tax (GST), company tax obligation, and payroll tax obligation. It is crucial for companies to sign up for an Australian Company Number (ABN) and, if appropriate, GST enrollment. These obligations require precise record-keeping and timely entries of income tax return.

In addition, taxpayers should know with available reductions and offsets that can minimize their tax obligation burden. Looking for guidance from tax obligation specialists can give useful insights into maximizing tax obligation placements while guaranteeing conformity with the law. Overall, a thorough understanding of tax commitments is vital for effective monetary preparation and to prevent fines related to non-compliance in Australia.

Crucial Files to Prepare

In addition, compile any relevant financial institution statements that show rate of interest earnings, in addition to returns declarations if you hold shares. If you have various other incomes, such as rental residential or commercial properties or freelance work, guarantee you have documents of these revenues and any connected costs.

Don't fail to remember to include reductions for which you might be eligible. This might include receipts for occupational costs, education and learning costs, or charitable contributions. Think about any type of private health insurance statements, as these can influence your tax obligation responsibilities. By collecting these crucial records in breakthrough, you will simplify your online tax return procedure, reduce errors, and take full advantage of possible reimbursements.

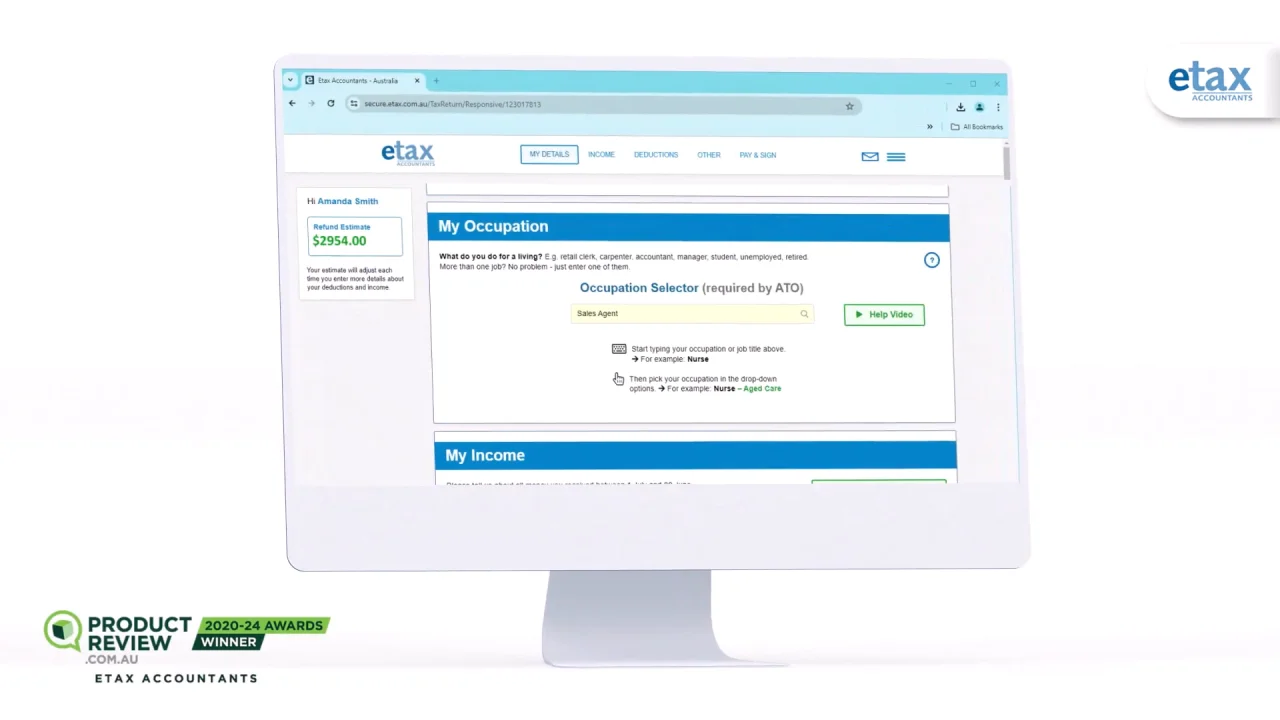

Selecting the Right Online System

As you prepare to file your online tax obligation return in Australia, picking the best system is crucial to make certain accuracy and ease of use. An uncomplicated, intuitive style can significantly enhance your experience, making it much easier to browse intricate tax types.

Following, analyze the system's compatibility with your financial circumstance. Some solutions cater particularly to individuals with simple tax returns, while others offer detailed assistance for a lot more intricate scenarios, such as self-employment or investment income. Additionally, search for systems that supply real-time mistake monitoring and advice, aiding to lessen mistakes and making sure conformity with Australian tax legislations.

An additional essential aspect to consider is the degree of customer assistance offered. Trustworthy systems need to provide access to assistance via conversation, email, or phone, especially throughout peak declaring periods. Additionally, study individual evaluations and ratings to gauge the total fulfillment and integrity of the system.

Tips for a Smooth Declaring Process

If you follow a couple of essential tips to make certain effectiveness and precision,Filing your online tax obligation return can be a simple procedure - online tax return in Australia. Gather all essential documents prior to starting. This includes your earnings declarations, receipts for deductions, and any other pertinent documents. Having everything at hand reduces errors and disruptions.

Following, make the most of the pre-filling feature provided by many on the internet platforms. This can save time and lower the opportunity of mistakes by automatically populating your return with info from previous years and information offered by your employer and monetary establishments.

Additionally, confirm all entrances for precision. online tax return in Australia. Errors can bring about postponed reimbursements or concerns with the Australian Taxes Workplace (ATO) Ensure that your personal details, income figures, and deductions are correct

Declaring early not only lowers tension but also enables for better preparation if you owe taxes. By following these tips, you can browse the online see this here tax obligation return process efficiently and confidently.

Resources for Aid and Support

Browsing the intricacies of online income tax return can often be complicated, but a range of resources for aid and support are conveniently available to assist taxpayers. The Australian Taxation Workplace (ATO) is the primary source of details, providing comprehensive overviews on its website, including Frequently asked questions, instructional videos, and live chat alternatives for real-time support.

In Addition, the ATO's phone support line is readily available for those who like straight communication. online tax return in Australia. Tax specialists, such as authorized tax obligation representatives, can also offer individualized guidance and guarantee conformity with current tax guidelines

Verdict

To conclude, efficiently browsing the on the internet income tax return process in Australia calls for a comprehensive understanding of tax obligation commitments, precise prep work of essential records, and mindful option of an appropriate online platform. Sticking to useful suggestions can enhance the filing experience, while available sources offer valuable assistance. By approaching the process with diligence their explanation and interest to information, taxpayers can make sure conformity and make the most of potential benefits, inevitably adding to an extra reliable and effective income tax return outcome.

As you prepare to file your online tax return in Australia, selecting the right system is vital to guarantee precision and ease of usage.In final thought, properly navigating the on the internet tax obligation return procedure in Australia calls for an extensive understanding of tax commitments, precise preparation of vital documents, and careful choice of an ideal online system.

Report this page